third annual survey shows high demand for all-natural options

We at Kari Gran conducted our third annual “Green Beauty Barometer” survey among American women to measure their attitudes and purchase behaviors toward all-natural beauty products.

TOP FINDINGS

Survey Purpose

- Do women intend to spend more on all-natural (green) beauty products in the next two years?

- Which beauty product categories are most important to women when it comes to being green?

- Which geographic and age groups see the most value in green beauty products?

- Do women read beauty labels prior to purchase and which chemicals are they trying to avoid?

- What socio-economic factors make a woman more likely to value green beauty products?

- How satisfied are women by all-natural beauty product selection in retail channels?

Methodology

The Green Beauty Barometer was conducted online within the United States by Harris Poll on behalf of Kari Gran from Sept. 6-8, 2017 among 1,293 U.S. women age 18 and older and from Aug. 9-11, 2016 among 1,126 U.S. women age 18 and older. These online surveys are not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables, contact PR@karigran.com.

At-a-glance findings

PRODUCT DEMAND BY CATEGORY

PRODUCT DEMAND BY AGE

PRODUCT DEMAND BY REGION

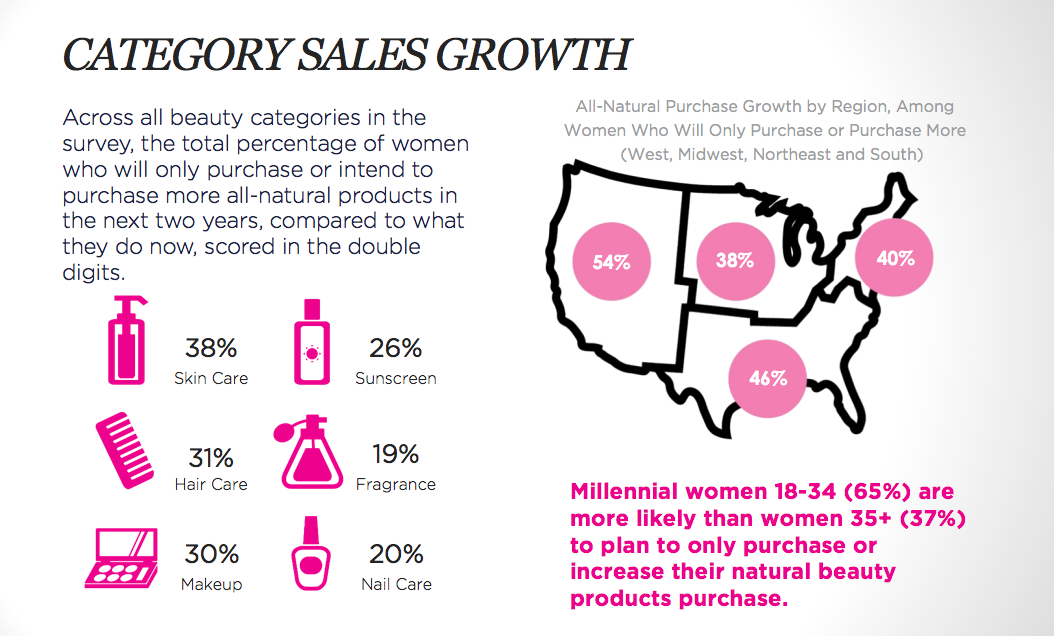

CATEGORY SALES GROWTH

LABEL READING: IT MATTERS

CHEMICAL CONCERNS

INGREDIENT AVOIDANCE BY AGE

RETAIL SHORTFALLS